tcco94

Future GTA VI Pilot

I found this being shared on LinkedIn awhile ago, and forgot to post for opinions. I know you (@ATN_Pilot) use to fly these birds and wondered what you thought.

Pretty lengthy, but interesting article.

https://www.linkedin.com/pulse/vision-717-how-delta-turned-jet-nobody-wanted-strategic-miller/

Pretty lengthy, but interesting article.

https://www.linkedin.com/pulse/vision-717-how-delta-turned-jet-nobody-wanted-strategic-miller/

The Vision of the 717 - How Delta turned the jet nobody wanted into a strategic powerhouse

The Boeing 717 is often referred to as the best airplane nobody wanted. Built as the last variant of the venerable DC-9 family, a total of only 155 717s ever entered service. With a small list of eight customers, the aircraft originally marketed as the MD-95 by McDonnell Douglas saw an insufficient level of interest that ultimately led to its cancellation. Of those customers, the largest was a small Orlando-based airline with a hub in Atlanta named Airtran. Originally ordered in January 1995 by Valujet Airlines, the order transferred during the merger with Airtran and first delivery was in September of 1999. A total of 88 717s (over half the number of aircraft ever built) found their way to Atlanta for the low cost carrier, who quickly put the aircraft to profitable use. While Airtran’s growth plans ultimately migrated from the 717 into the larger 737 Boeing was offering, the 717 remained the core of the airline. Much to the frustration of Delta leadership who, from the windows of their headquarters in Atlanta could watch the Airtran 717s depart, the small narrow-body had become a permanent fixture in the skies over Northern Georgia. Little did they know just how long the aircraft would be associated with Atlantan skies and fortunes, with only a slight change of paint.

After a short bidding war for Airtran, Southwest Airlines acquired the airline which also put the fleet of 717s in question. Yet, in a fulfillment of the aircraft’s apparent destiny to be tied with Georgia, a deal was announced in 2012 that would see the 88 ex-Airtran 717s leased to their long-time Atlanta rival, Delta.

As Southwest had long touted the benefits of fleet commonality, the reason for the divestiture of the 717s came as no surprise. On the Delta side, however, questions remained about how the aircraft would be used. The 717s was “…very much about how do we get out of the regional jets,” according to Ed Bastian of Delta in a recent Business Insiderarticle. Yet this explanation remained oversimplified. The addition of the 717s actually allowed Delta to acquire 70 more large regional jets, while only reducing the number of 50-seat regional jets.

The overall fleet effect at Delta was 717s in, 50-seat jets outA recently retired fleet of DC-9 aircraft left some in the industry feeling as though Delta had a unique 110-seat niche unavailable to other airlines. Meanwhile, competitors such as American and United claimed the 110-seater had no place in their cost structures and that the success of the 717 was unique to Delta’s Atlanta hub, something not available in other areas of the country. In the end, there was no consensus within the industry as to how Delta would use the aircraft, and that lack of consensus largely survives today.

Now, six years later, all 88 717s have been in operation with Delta almost five years (along with another three aircraft acquired separately). The aircraft has been a success for Delta, and with the help of data we can look back to determine exactly how the 717 was used as a strategic tool. We can also speculate whether the success of the 717 is limited to Delta, or whether it could be applied to other airlines, continuing the small narrow-body renaissance initially started in Atlanta.

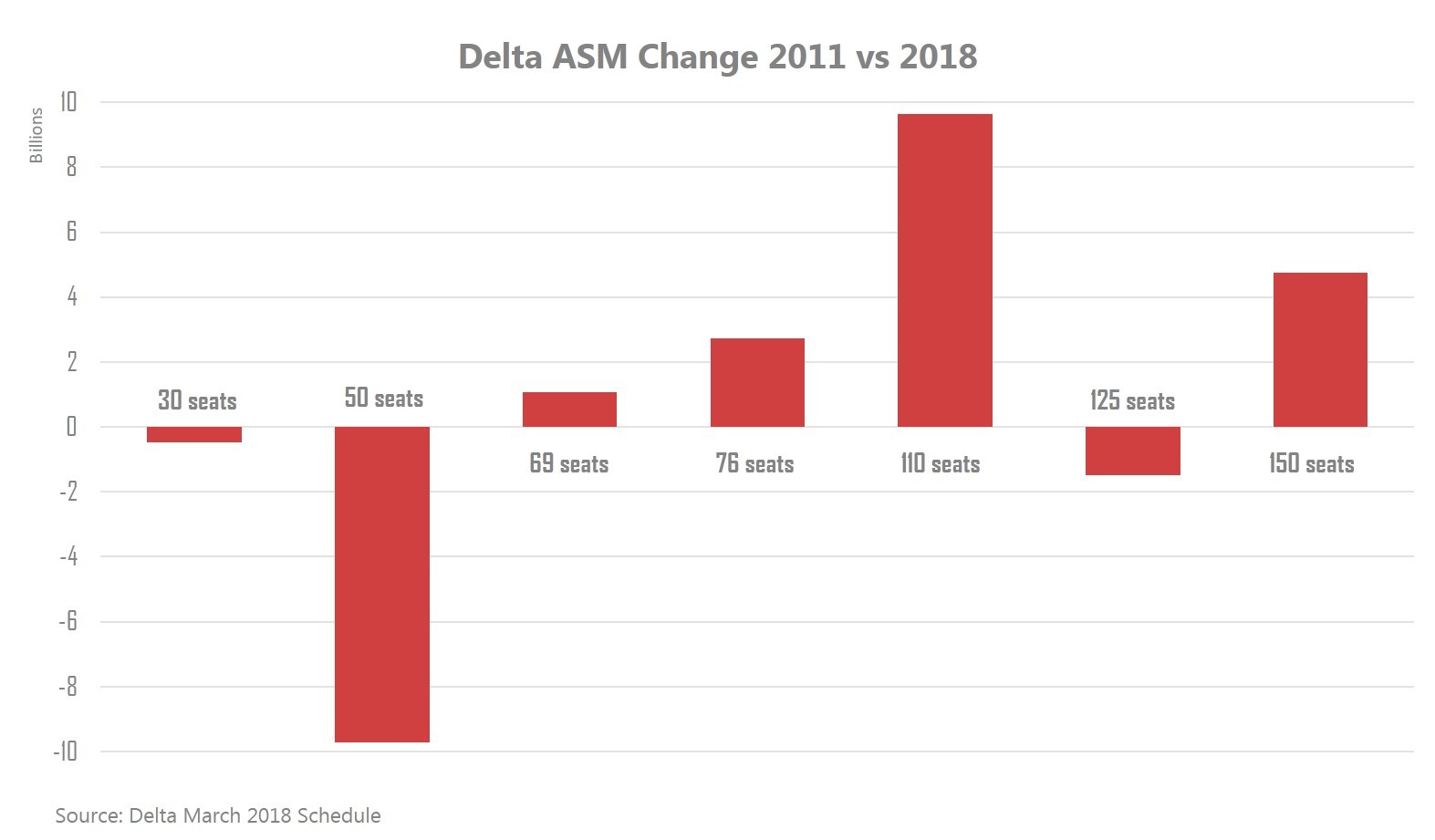

Fleet Moves – Which aircraft were replaced by the 717?

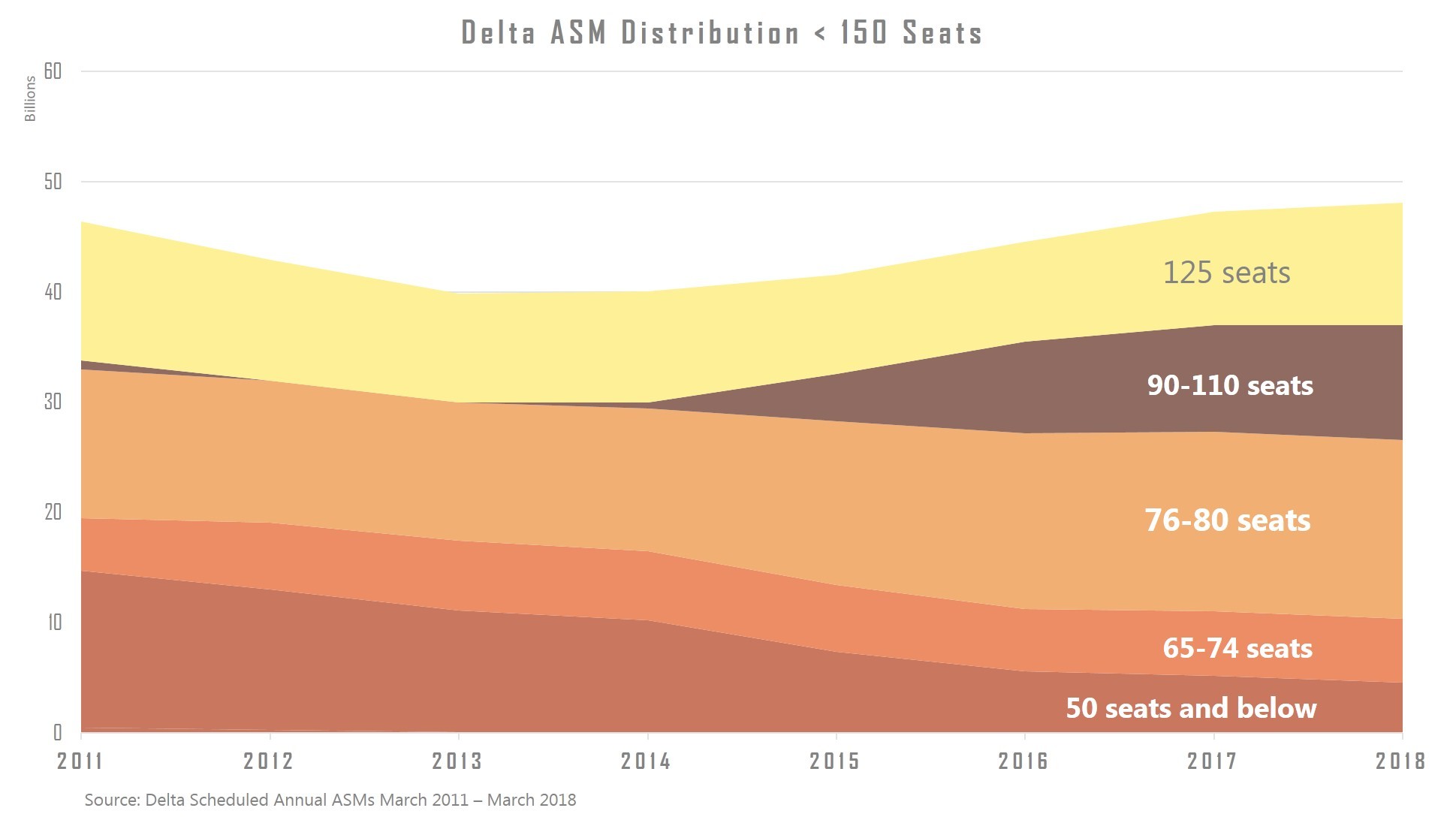

With the addition of the 717, Delta was able to optimize the network by shifting fleet capacity in a way that ultimately replaced 50-seat flying. In a one-for-one replacement of ASMs, as the 717 capacity entered, the 50-seat capacity left the Delta system. This allowed Delta to remove 2.2 50-seat regional jets worth of flying for every 717 that arrived. Yet exactly how the 717 came to replace the 50-seat jets is often overlooked since Delta didn’t simply turn two 50-seat flights into one 717. By taking a truly holistic view of the fleet, Delta was able to cascade the changes by turning 50-seat markets into 65-seat markets, 65-seat markets into 76-seat markets, and 76-seat markets into 110-seat markets. The overall fleet effect was 717s in, 50-seat jets out, with a net decrease in seat costs across the Delta system for a net increase in mainline and premium class service. The addition of the 110-seater to Delta’s repertoire gave them a tool to better align capacity to demand by looking at not only mainline or regional markets separately, rather as a whole for which the 717 became the perfect transition.

Looking at the evolution of small aircraft across Delta’s fleet, the strategic importance of the 717 becomes apparent. As the 50-seat fleet was reduced, the addition of the 88 717s (and 70 large regional jets made available as a result of the 717’s arrival) were used to maintain overall ASM levels. The use of 50-seat aircraft was reduced to better fit the network needs, and the fleet mix was brought back into line with passenger demand. At the same time Delta was reducing network seat costs and optimizing the fleet, the percentage of ASMs that were attributed to business class and premium economy seats grew. With total small aircraft ASMs increasing by only 5% between 2011 and 2018, the number of first class ASMs grew by a whopping 40%. Today, 11.6% of the ASMs produced by Delta’s fleet under 150 seats are first class seats. This compares with 9.9% and 8.5% at American and United, respectively.

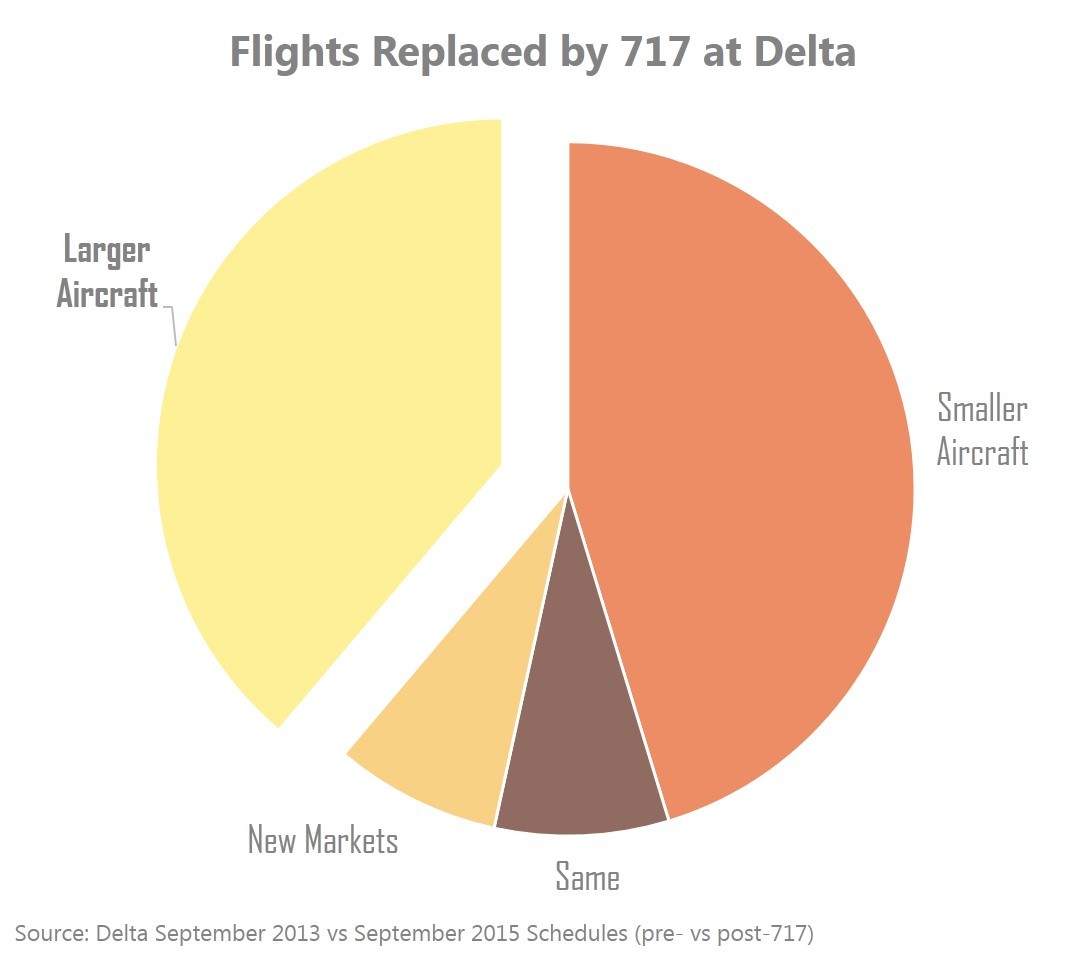

Deploying the 717s across the network

Examining Delta’s deployment of the 717 from an individual flight level shows just how much optimization the network was able to find with the new aircraft. Even though system capacity changed at a 1:1 ratio with departing 50-seaters, the actual routes on which the 717 was deployed varied between larger and smaller aircraft. Very few aircraft were used for new markets or to replace original DC-9 routes. In fact, 39% of the flights flown by the 717 were operated by larger aircraft in 2011, and 45% were up-gauged from smaller regional jets. This combined 84% of the 717s flights were used to better align capacity with demand, a key factor in Delta’s domestic RASM leadership that exists even today.

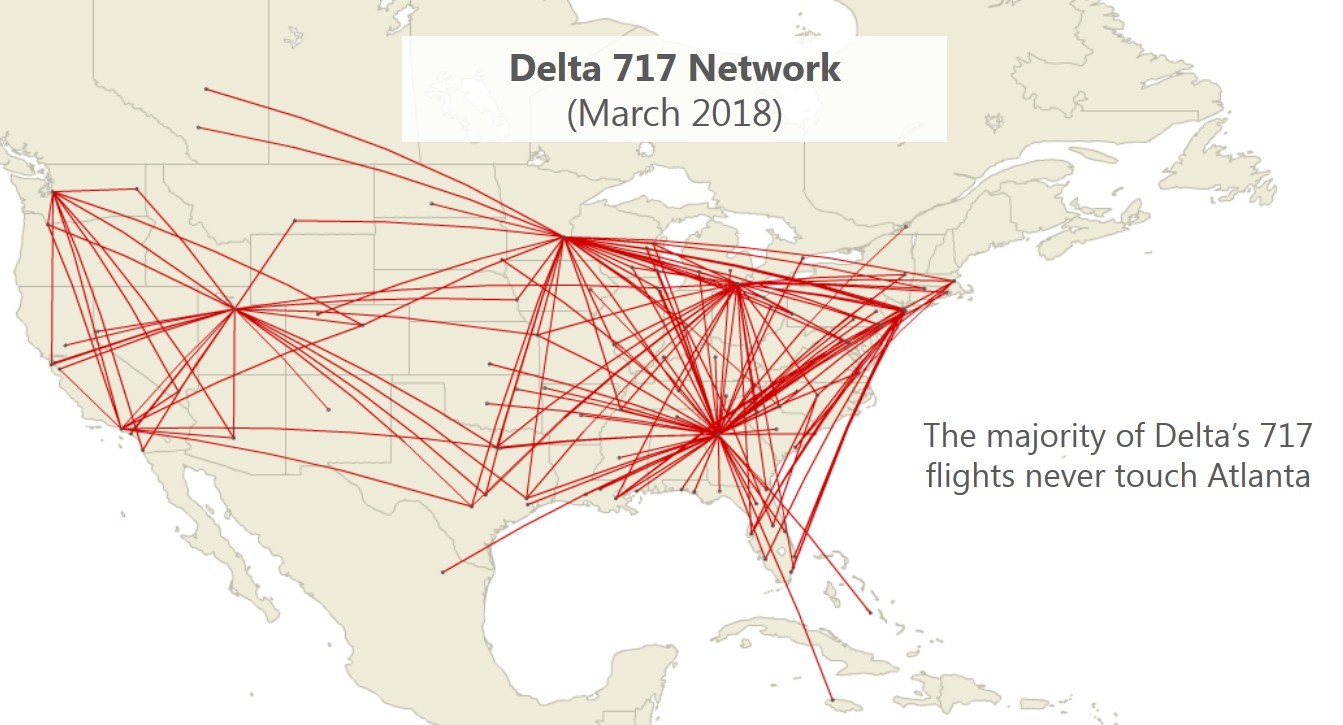

Is the 717 success limited to the Atlanta hub, as some competitors have claimed? In a word, no. In fact, not only is the 717 not reliant on Atlanta, over half of Delta’s 717 network doesn’t even touch Atlanta. Beyond flights through all hubs, including Minneapolis, Detroit, New York, Salt Lake City, Los Angeles, and Seattle, the 717 has also found an impressive ability to bypass hub markets with flights from the northeast and Carolinas directly into Florida. And this should come as no surprise. The aircraft fits a seat gauge required across all of Delta’s network, and Delta has deployed it accordingly, further suggesting the benefits of this type would not be limited to Delta. Yet Delta remains the only legacy carrier serving this market size in the U.S., a near-monopoly they have enjoyed for over 5 years.

Competing with the 717

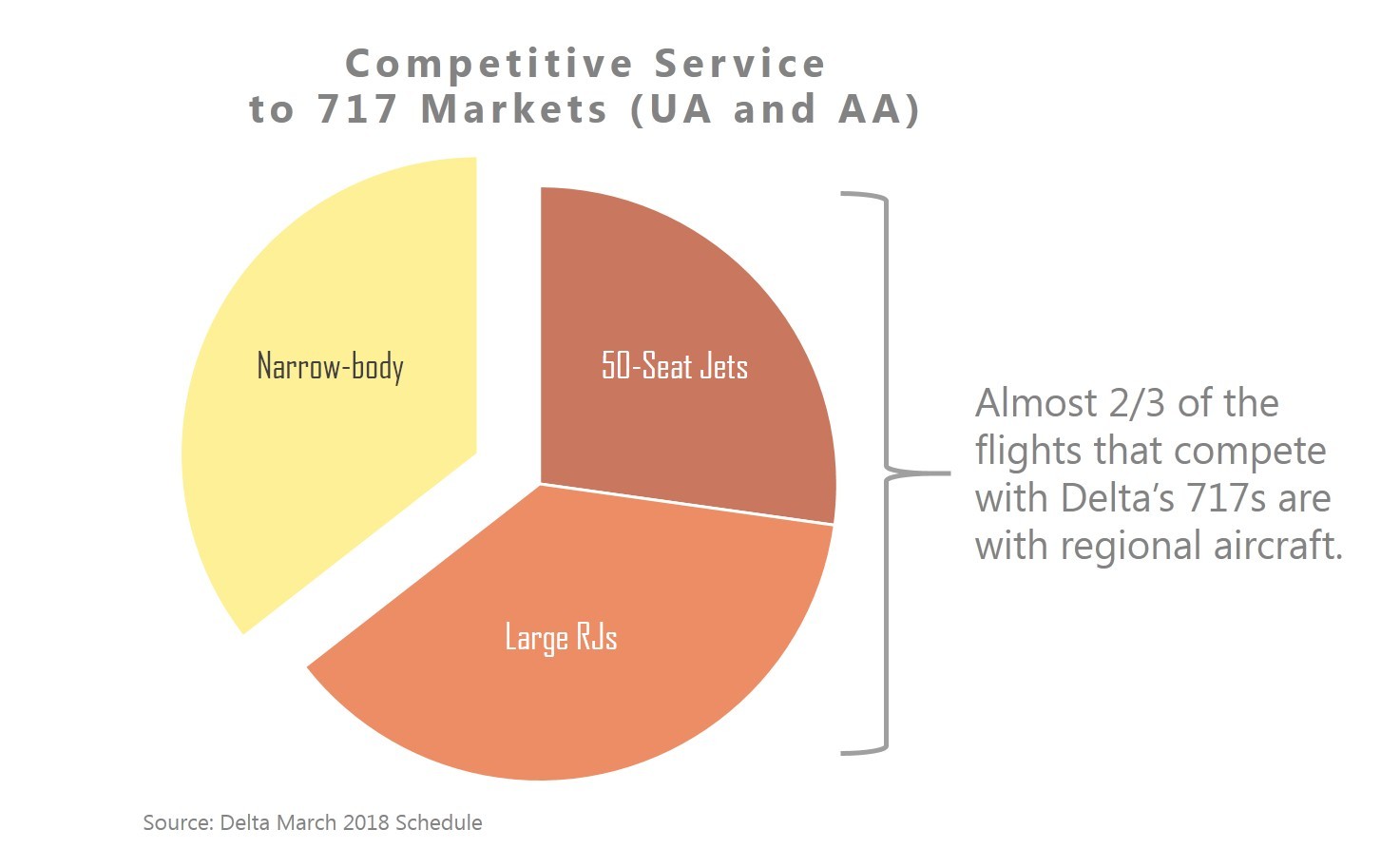

The 717 brought Delta the ability to optimize the network in ways their main competitors could not. Beyond that benefit, however, came the additional ability for Delta to compete in markets with higher levels of service than American or United. As of today, the 717 sees two-thirds of its non-hub competition from regional jets, and over one-quarter from the older 50-seat jets without a business class section. This competitive advantage for Delta at a passenger service level is significant. As Delta looks to fill higher yielding business class seats on international flights by connecting markets with the 717, the consistent level of service for the passenger becomes a powerful differentiator.

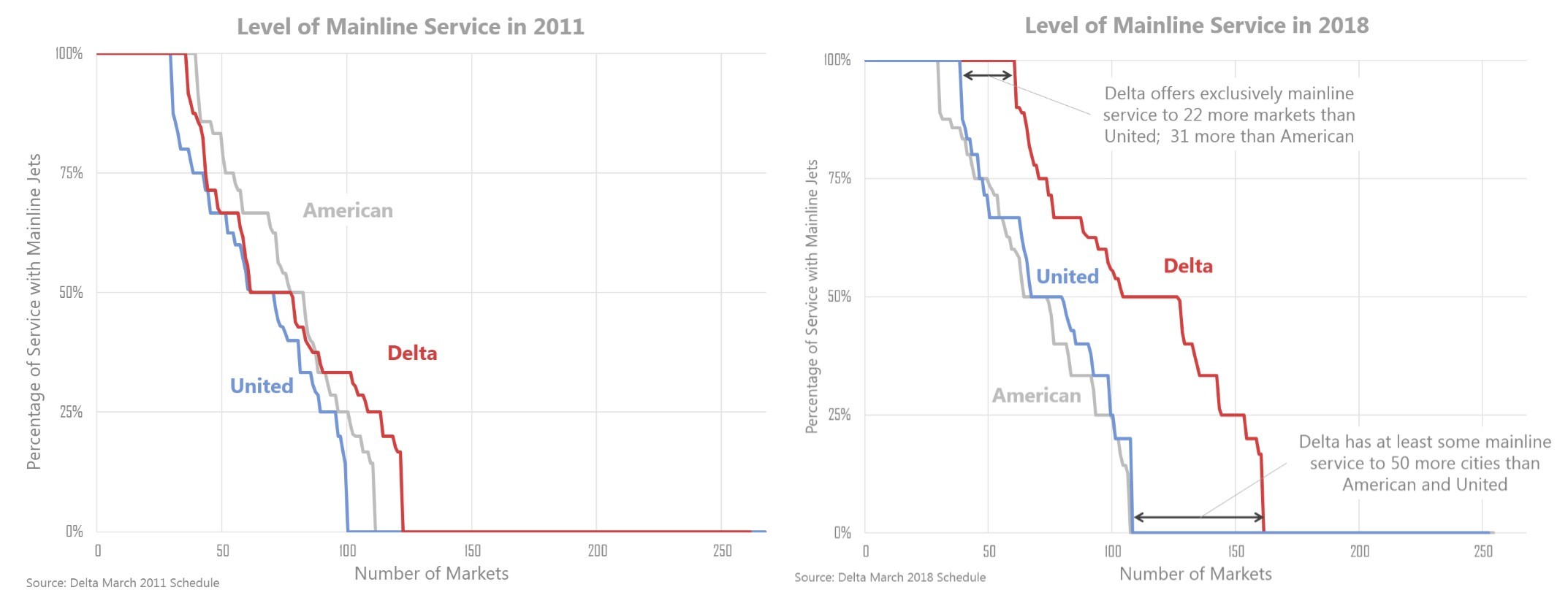

Looking at the service levels of the legacy carriers from a different perspective, you can start to see how Delta created and extended a mainline service advantage over United an American after the 717 introduction. The above chart shows the number of markets that saw a certain level of mainline service at each of the three carriers. In 2011, all three were competitively aligned with approximately 40 markets receiving 100% mainline service. Roughly 70 markets for each of the carriers saw some mixture of mainline and regional service with Delta slightly leading the pack with 122 markets seeing at least some service by mainline jets.

Delta clearly leads the U.S. domestic legacy airlines with the most mainline service to its networkBased on the level of service seen today, Delta clearly leads the U.S. domestic legacy airlines with the most mainline service to its network. Delta currently serves 22 more cities with dedicated mainline service than United and 31 more than American. This advantage extends to 50 more cities with at least some mainline service than American or United, and is a welcomed byproduct of the 717 as it is deployed against the competition’s regional fleet.

Delta’s opportunistic acquisition of the 717 was enabled by more than just a willing seller and the vision to act. It can easily be argued that Delta’s capable in-house maintenance group, called TechOps, allowed Delta to incorporate an older aircraft into the fleet without a drop in reliability. While American and United outsource most of their heavy maintenance work that Delta completes through TechOps, the difference hardly matters as it relates to a 110-seater. Delta made further moves into the new 110-seat market, purchasing 75 CS100s in 2016.

The vision Delta showed in acquiring the 717 speaks to the success the airline is seeing across the boardOf course any aircraft can be made attractive at the right price, and this has sometimes been rumored to be the case with Delta’s 717s as well. While details of the transaction between Southwest and Delta remain confidential, we do know from comments made during a Q2, 2012 earnings call at Southwest how the deal was structured. $140 million was paid by Southwest and Boeing to convert the aircraft to Delta’s specification with paint and new interiors, after which the lease costs became “essentially a wash” according to Southwest. This implies Delta simply took over the same leases on the 717s that Airtran/Southwest had paid, while the additional cost to move the fleet was picked up by Southwest and Boeing. A good deal by both airlines, and one that apparently resulted in Delta simply assuming the same rates paid by Southwest and Airtran. Regardless the rumors, the 717 stands on its own economic merits at Delta.

There is no single reason why the 717 works for Delta. Between the rugged build of the aircraft, Delta’s technical capability, the reduction in over-all fleet seat costs, and the improvement in premium and consistent service offerings, the vision Delta showed in acquiring the 717 speaks to the success the airline is seeing across the board. McDonnell Douglas and the original MD-95 program furthered the legacy of the DC-9 in this design on whose success would require the vision of a major airline. That vision would come 15 years too late for the company and the program, however come it did, with Delta Air Lines. The 717 will undoubtedly remain a strategic and successful part of Delta’s fleet for years to come.