I really don't know what to tell you other than you're just dead wrong. I've been looking at airline financial statements (including under confidentiality agreement) for many years. I can tell you without a shadow of a doubt that your numbers are so far off it isn't even funny.

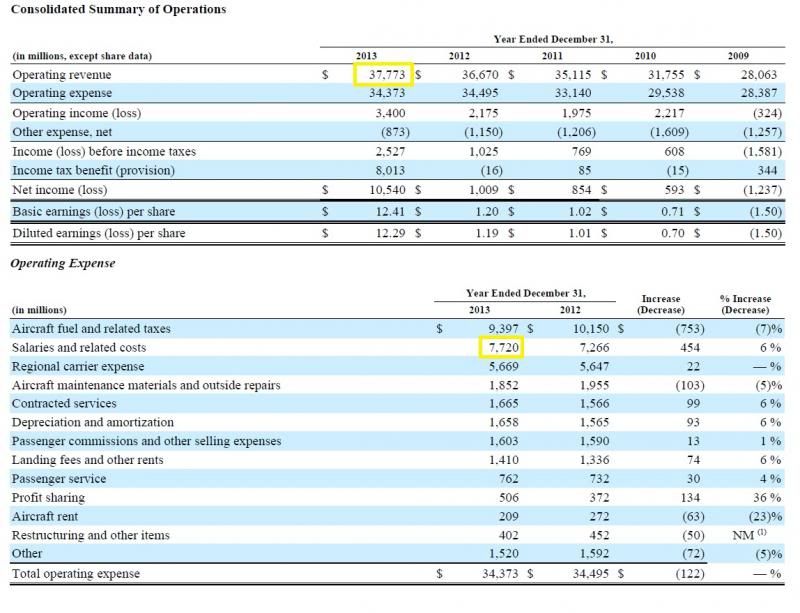

I'm not. Not even close. But clearly you don't understand just how significant a portion of the company's costs are labor costs. Total labor costs of the average airline are at about 35%, just a bit below fuel, which is usually around 35-45%, depending on how the fuel is fluctuating that month. Of that, the pilot payroll is a huge chunk. About 7-15% of total expenditures is what you can usually expect. You have to keep in mind that we're talking payroll here and not just net compensation paid to pilots. It includes company paid social security and medicare, retirement contributions, insurance, disability, sick pay, etc.