We’ve all seen it happen over time slowly then suddenly:

View attachment 86340

There are dozens of indicators. I’ve already posted lots of information on this and in typical JC fashion it’s ignored every time. Also I’m now accused of being a “crypto grifter” lol even though I’ve specifically said on this thread it’s not the best place for your Emergency fund.

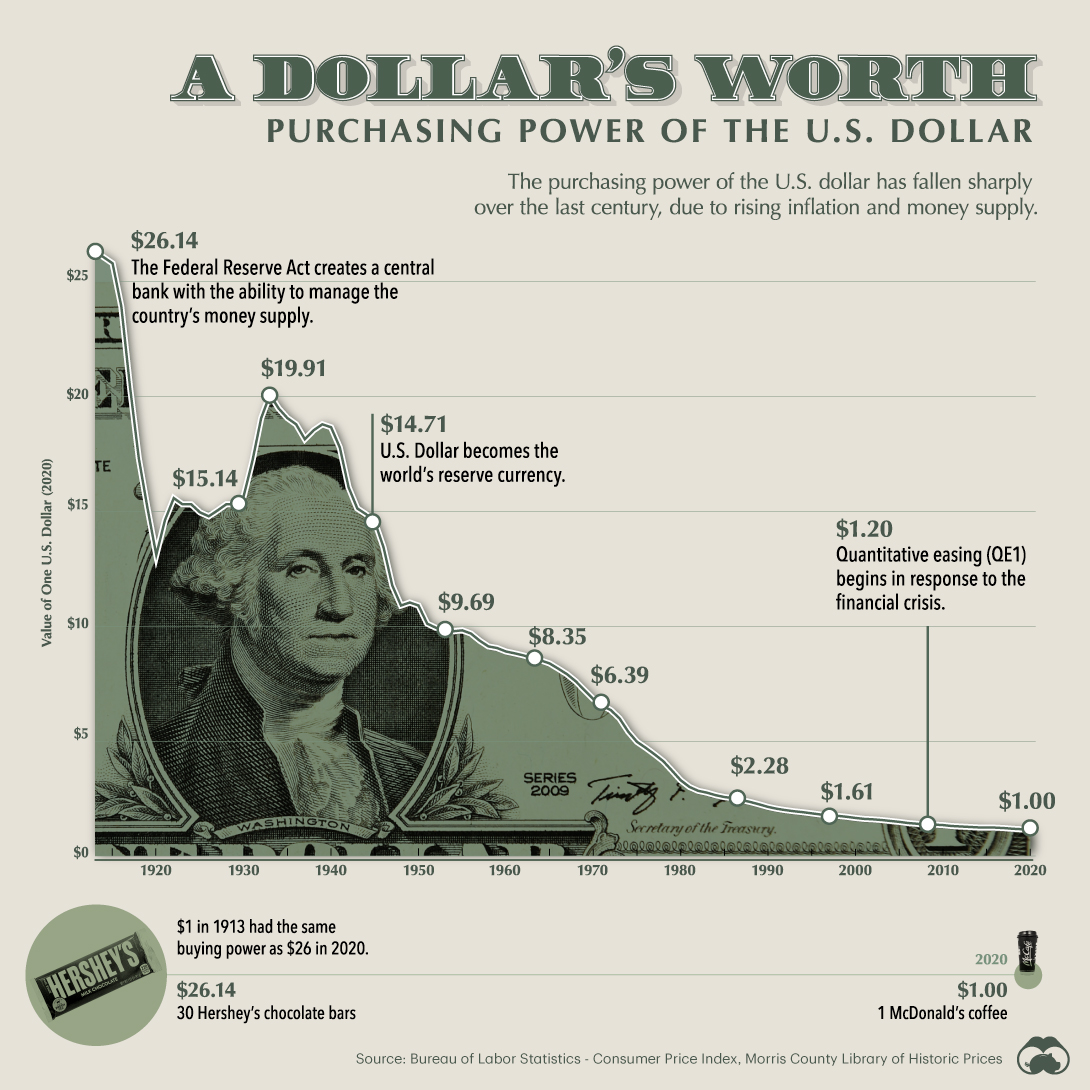

Here is one of the best summaries on the debasement of your dollar:

$1 in 1913 had the same purchasing power as $26 in 2020. This chart shows how the purchasing power of the dollar has changed over time.

www.visualcapitalist.com

Don’t take it from me take it from Morgan Stanley our dollar could lose 20% of it’s value this year:

Those index funds in the 401K. The reason they are going up at around 14% a year is because the rate of return is measured in dollars…

View attachment 86341